Just How Livestock Threat Security (LRP) Insurance Can Protect Your Livestock Financial Investment

In the realm of livestock financial investments, mitigating dangers is extremely important to making sure financial stability and development. Livestock Danger Protection (LRP) insurance coverage stands as a trustworthy guard versus the unforeseeable nature of the marketplace, providing a strategic method to guarding your properties. By diving into the intricacies of LRP insurance coverage and its complex advantages, livestock producers can fortify their financial investments with a layer of protection that transcends market changes. As we check out the world of LRP insurance coverage, its duty in securing livestock investments ends up being significantly obvious, assuring a course in the direction of lasting financial resilience in an unstable market.

Understanding Livestock Risk Defense (LRP) Insurance Policy

Comprehending Livestock Risk Protection (LRP) Insurance policy is crucial for livestock producers seeking to mitigate monetary risks connected with rate changes. LRP is a government subsidized insurance coverage product developed to protect manufacturers against a decrease in market prices. By giving insurance coverage for market cost decreases, LRP assists manufacturers lock in a flooring price for their animals, making certain a minimum degree of revenue no matter of market fluctuations.

One secret aspect of LRP is its adaptability, enabling manufacturers to customize protection levels and plan sizes to suit their certain needs. Producers can pick the number of head, weight array, coverage cost, and insurance coverage period that align with their production goals and take the chance of tolerance. Comprehending these personalized options is important for manufacturers to properly manage their rate threat exposure.

Additionally, LRP is available for various livestock kinds, consisting of livestock, swine, and lamb, making it a versatile danger monitoring device for livestock producers across different markets. Bagley Risk Management. By acquainting themselves with the ins and outs of LRP, manufacturers can make enlightened choices to secure their financial investments and ensure financial stability when faced with market unpredictabilities

Advantages of LRP Insurance Coverage for Animals Producers

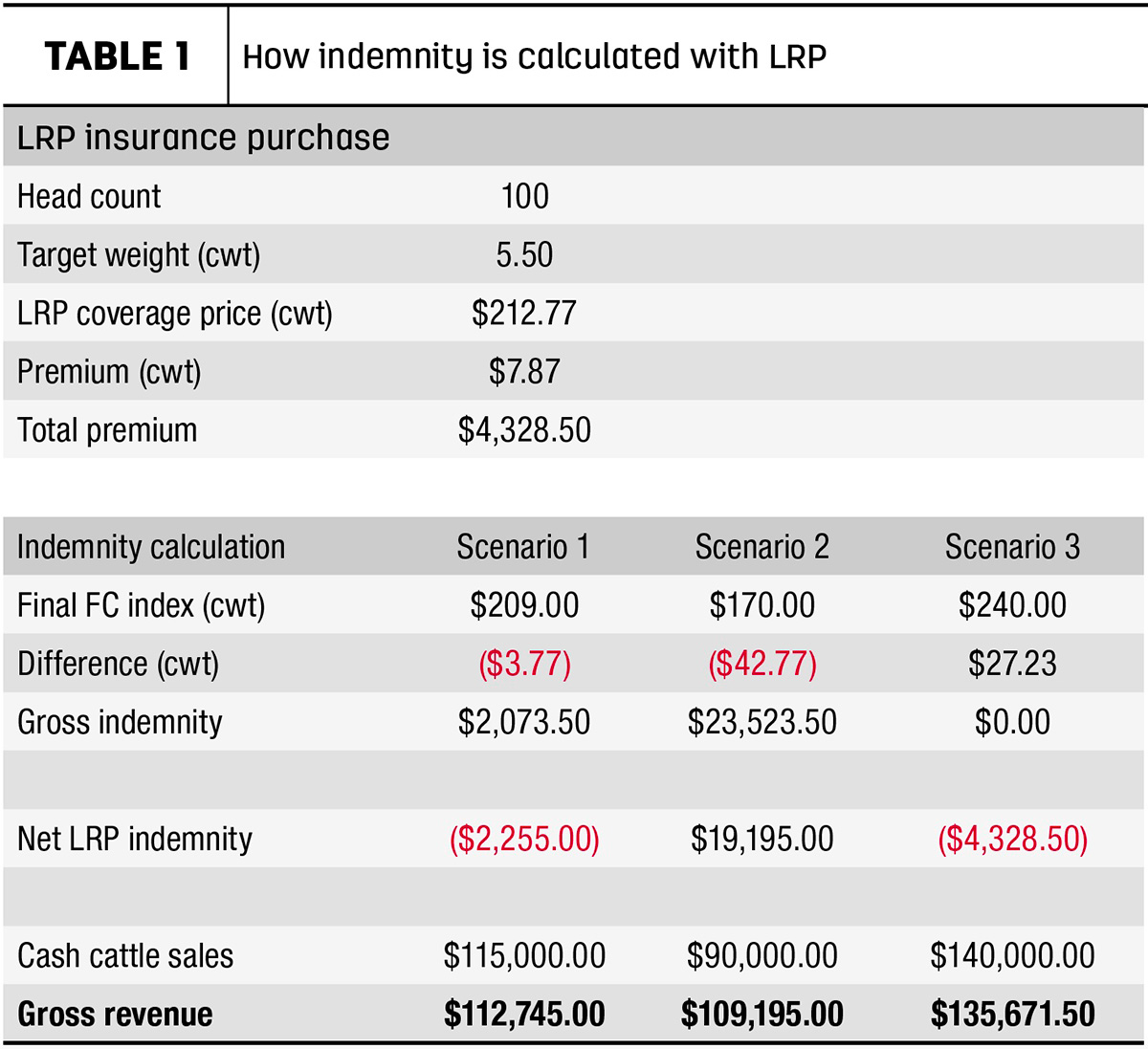

Livestock manufacturers leveraging Animals Threat Security (LRP) Insurance coverage get a critical benefit in securing their financial investments from cost volatility and protecting a steady monetary ground amidst market unpredictabilities. One vital benefit of LRP Insurance policy is rate defense. By setting a floor on the rate of their animals, producers can reduce the danger of significant monetary losses in the occasion of market downturns. This permits them to intend their budget plans better and make informed decisions about their procedures without the consistent concern of cost fluctuations.

Moreover, LRP Insurance gives producers with tranquility of mind. Overall, the benefits of LRP Insurance coverage for livestock producers are substantial, offering a beneficial device for taking care of threat and making certain economic protection in an uncertain market atmosphere.

Exactly How LRP Insurance Coverage Mitigates Market Dangers

Reducing market threats, Animals Threat Protection (LRP) Insurance coverage supplies livestock manufacturers with a trustworthy shield against cost volatility and financial unpredictabilities. By providing protection versus unanticipated cost drops, LRP Insurance policy assists manufacturers browse around these guys protect their financial investments and preserve financial security in the face of market variations. This sort of insurance policy enables livestock manufacturers to lock in a cost for their pets at the beginning of the plan period, making certain a minimum rate level no matter of market changes.

Steps to Protect Your Livestock Investment With LRP

In the world of farming threat administration, applying Animals Risk Defense (LRP) Insurance entails a calculated procedure to safeguard investments against market fluctuations and uncertainties. To secure your livestock investment efficiently with LRP, the first action is to evaluate the certain dangers your procedure faces, such as price volatility or unforeseen weather condition occasions. Next off, it is vital to study and choose a credible insurance policy service provider that provides LRP plans customized to your animals and service demands.

Long-Term Financial Safety And Security With LRP Insurance Policy

Making certain enduring monetary stability via the use of Animals Danger Defense (LRP) Insurance is a prudent long-term approach for agricultural producers. By integrating LRP Insurance right into their threat administration plans, farmers can protect their livestock investments versus unpredicted market changes look at more info and unfavorable events that might endanger their monetary well-being over time.

One trick benefit of LRP Insurance for long-lasting monetary safety is the assurance it uses. With a dependable insurance plan in location, farmers can mitigate the economic risks connected with unstable market conditions and unanticipated losses due to aspects such as illness outbreaks or all-natural disasters - Bagley Risk Management. This stability permits producers to concentrate on the day-to-day operations of their animals service without constant stress over possible financial problems

Furthermore, LRP Insurance provides an organized strategy to taking care of risk over the long-term. By establishing details protection degrees and selecting ideal recommendation periods, farmers can customize their insurance coverage prepares to line up with their economic goals and run the risk of tolerance, making sure a secure and lasting future for their livestock procedures. In conclusion, purchasing LRP Insurance policy is a proactive method for farming manufacturers to achieve long lasting economic security and secure their resources.

Conclusion

In final thought, Animals Risk Protection (LRP) Insurance coverage is a beneficial device for animals producers to mitigate market dangers and protect their financial investments. By understanding the benefits of LRP insurance and taking steps to execute it, producers can attain long-term financial safety and security for their operations. LRP insurance coverage supplies a safety and security internet versus cost changes and makes sure a degree of stability in an unforeseeable market atmosphere. It is a wise selection for protecting livestock financial investments.